So I was fiddling with my Solana wallet the other day, trying to figure out which validator to stake with. Honestly, it’s not as straightforward as you’d think. You’d imagine all validators are created pretty equal, right? Nope. Wow! The more I dug in, the more I realized this whole validator selection thing is like choosing a good mechanic in a new town—some are solid, others? Well, you get what you pay for.

My first impression was that staking on Solana is a simple “set it and forget it” deal. But then I started seeing how validator performance, commission rates, and reliability can dramatically affect your rewards. Hmm… something felt off about just blindly delegating to the biggest name. On one hand, larger validators seem safer, though actually, smaller ones sometimes offer better returns. It’s a bit of a balancing act.

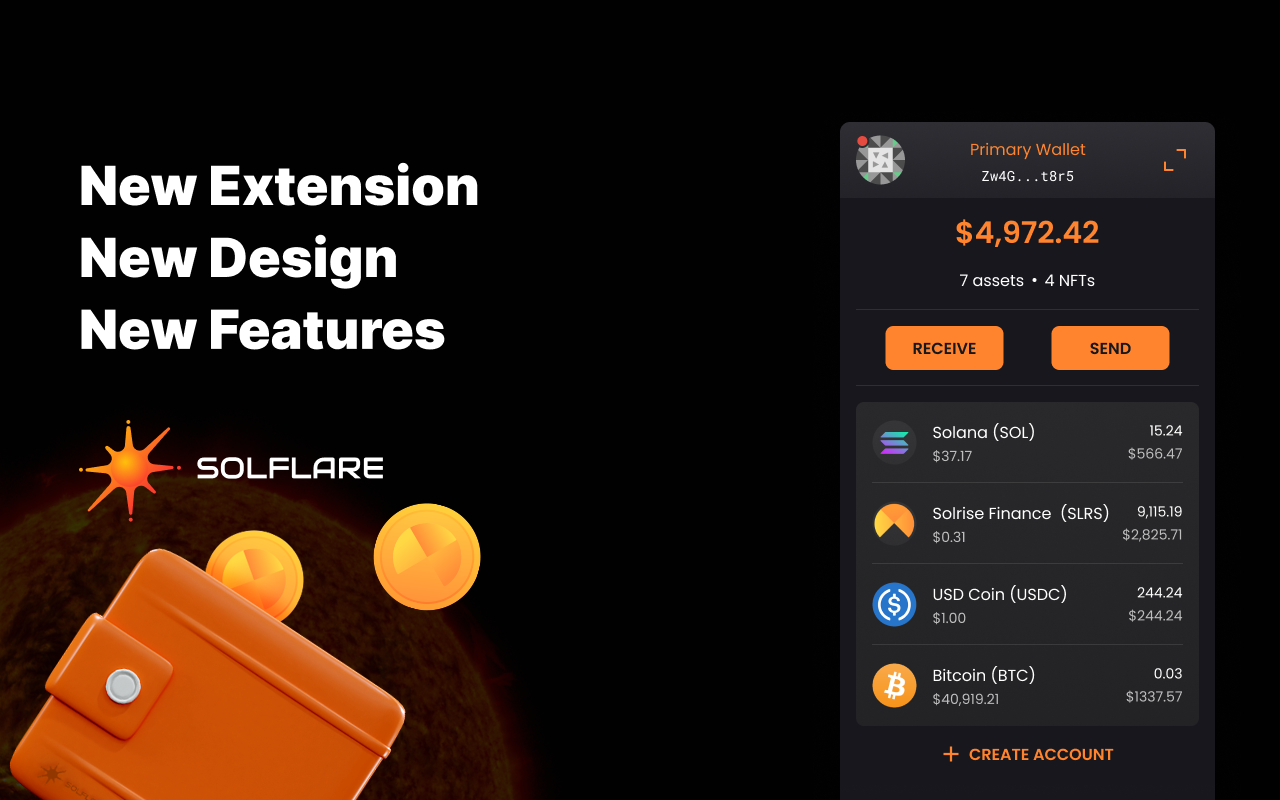

Okay, so check this out—if you’re into staking and DeFi on Solana, using a wallet like the solflare wallet extension makes the process smoother. I’ve been using it for a while, and it’s got this clean interface that helps you track your staking rewards without needing to dive into command line tools. But beyond the wallet, your validator choice is crucial.

Here’s what bugs me about some staking guides: they often gloss over the nitty-gritty of validator reliability. It’s not just about who pays the highest rewards. Some validators might have downtime or even get slashed, which can cost you. Initially, I thought “well, just pick the highest APR,” but then I realized, high APR sometimes means higher risk or aggressive commission policies.

Really? Yep. Validators charge commissions on your rewards, usually between 5-10%, but some go higher. That can eat into your earnings big time if you’re not paying attention. On top of that, validators with poor uptime reduce the overall staking yield because they miss out on block rewards. Those little details make a huge difference over months or years of staking.

Digging deeper, I found that validator performance metrics are public but can be overwhelming. There’s stuff like vote credits, skipped slots, and identity verification. I’m biased, but I tend to lean towards validators with transparent teams and active community involvement. It’s not foolproof, but it helps. Also, validators that actively participate in governance often have a better understanding of network upgrades, which indirectly benefits stakers.

Oh, and by the way, staking with multiple validators can spread your risk. I tried splitting my delegation between a couple of medium-sized validators to see if that changed my rewards. It did, slightly—though the extra management overhead isn’t trivial. For casual users, one solid validator might be the way to go.

Here’s a quirky tidbit: some validators offer “bonus” incentives or partner with DeFi projects, but these can come with strings attached. Sometimes they require you to lock your stake longer or join their ecosystem exclusively. I dipped my toes in one such offer, but honestly, it felt a bit like a gimmick. The core staking rewards still hinge on validator uptime and commission.

So, what’s the best way to vet a validator? I started by checking performance dashboards and community forums, then cross-referencing that with the solflare wallet extension’s staking interface which lists validators and their stats. It’s kind of like dating—look for consistency, reputation, and responsiveness. If a validator has frequent downtime or vague communication, that’s a red flag.

Staking Rewards: More Than Just Numbers

At first glance, staking rewards look like a fixed percentage. But actually, rewards fluctuate based on network participation rates and inflation schedules. Solana’s inflation rate, for example, is designed to decrease over time, which means your staking yield might slowly decline. I wasn’t 100% sure how this would affect long-term staking until I crunched some numbers recently.

Something else: rewards compound if you keep restaking them, but not all wallets support auto-compounding. The solflare wallet extension does a decent job at reminding you when you have rewards to claim and restake, but it’s not automatic. I’ve missed out on some gains just because I forgot to claim during busy weeks.

On the flip side, staking isn’t risk-free. Validators can get penalized for misbehavior, and though slashing is rare on Solana, it’s not impossible. Also, unstaking takes a cool-down period—around 2 days—which means your funds aren’t instantly liquid. That’s something to keep in mind if you need quick access or wanna jump into a hot DeFi opportunity.

Here’s the thing. I initially thought staking was just a passive income stream, but it’s more like tending a garden. You gotta monitor, adjust, and sometimes move your delegation. I even noticed that sometimes switching validators mid-way can be beneficial if your current one’s performance dips.

By the way, validator diversity is good for network health, so consider delegating to smaller or newer validators if you’re comfortable with the slight risk. It’s kinda like supporting local businesses versus big chains—there’s a community benefit that’s harder to quantify but still real.

Finally, if you’re serious about maximizing staking on Solana, combining a reliable wallet like the solflare wallet extension with careful validator selection and active reward management can make a noticeable difference in your crypto portfolio over time. Just don’t expect it to be a “set it and forget it” deal forever—there’s some work involved, but hey, that’s part of the fun.

Wow! So much to consider, right? But honestly, once you get the hang of it, staking on Solana becomes a pretty rewarding (pun intended) experience. Keep your eyes peeled, trust your gut, but back it up with a bit of digging. And if you’re new to this, start small, use reliable wallets, and maybe avoid the hype-driven validator choices at first.